By Jan Worth-Nelson

Just in time for the first of two town halls about the pending proposal for the .96 Arts Education and Cultural Enrichment millage for Genesee County, Mark Sinila, CEO of the Flint Cultural Center Foundation, today released the much-speculated-about “memo of understanding” detailing who would get what in the predicted $8.7 million yearly revenue if the measure passes Aug. 7. The press release was released under the name of Todd Slisher, executive director of the Sloan Museum/Longway Planetarium.

Tonight’s 7 p.m. town hall will be at The New McCree Theater, 2040 W. Carpenter Rd.

A second town hall has been scheduled for 7 p.m. Tuesday, July 24 at The Whiting auditorium, 1241 E. Kearsley St.

Here is the section of the memo addressing the predicted fund allocations:

“Funding

As outlined below, the Flint Cultural Center Foundation will receive the balance of monies available based on .96 mills, per the passage of the millage for a countywide winter tax collection, from the Genesee County Board of Commissioners for a duration of 10 years beginning in December 2018 and will receive this sum annually until December of 2027.

The balance of monies available based on .96 mills will be lessened by $500,000 in direct grants paid to the Greater Flint Arts Council and lessened by the the following local authorities are expected to capture and receive a disbursement of a portion of the millage, if approved: City of Clio Downtown Development Authority (“DDA”) and Neighborhood Improvement Authority (“NIA”); City of Davison DDA and Local Development Finance Authority (“LDFA”); City of Fenton DDA and LDFA; City of Flint DDA and Tax Increment Finance Authority; City of Flushing Corridor Improvement Authority (“CIA”) and NIA; City of Grand Blanc DDA and Brownfield Redevelopment Authority (“BRA”); City of Linden DDA; City of Montrose DDA; City of Mt. Morris DDA; City of Swartz Creek DDA; Genesee County BRA and Land Bank Authority; Davison Township DDA; Hill Road CIA; Mt. Morris Township Business Development Authority (“BDA”); Vienna Township BDA; Village of Lennon DDA; Village of Otisville DDA; and Village of Otter Lake DDA. The total amount of tax increment revenue projected to be captured in the first year of the millage is estimated to be [$193,941.96].

Millage total is .96 mills = $8,775,654.56

minus 193,752.96 to the local DDA and BDA (as required by state law) minus $500,000 for grants to be administered by the Greater Flint Arts Council

Equals total estimated millage amount of $8,081,902.21 to be disbursed by FCCF annually as follows:

Flint Institute of Arts (0.2 mills annually) = $1,792,413.11

Flint Institute of Music (0.2 mills annually) = $1,792,413.10

Sloan*Longway (0.2 mills annually) = $1,792,413.10

The Whiting (0.2 mills annually) = $1,792,413.10

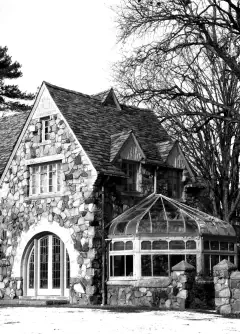

The Floyd J. McCree Theatre (The New McCree Theatre) (.0469 mills annually) = $412,246.63

The Friends of Berston Fieldhouse (.0469 mills annually) = $412,246.63

The Greater Flint Arts Council (.01 mills annually) = $87,756.54

Legal Note: Set millage amounts cannot be guaranteed due to Headlee rollbacks and tax captures in future years. .96 mills only will be levied in 2018. In future years, the number of mills will be reduced by Headlee rollback and a portion of the levy always will be captured by tax capturing entities without a change in state law. The revenue stream can grow each year, but only marginally (roughly 2.5%). Headlee rolls back rates to prohibit revenue growth beyond an inflation factor. Unless voters approve a Headlee override.

All dollar amounts are projections based on the total mils collected via homestead taxes in Genesee County. Should the total mils either increase or decrease – the allocated mils numbers will be relied upon rather than the dollar amounts.”

Flint Cultural Center officials had previously declined to release the allocation amounts because they said other cultural center executives had not signed off.

EVM Editor Jan Worth-Nelson can be reached at janworth1118@gmail.com.

You must be logged in to post a comment.