By Jeffery L Carey, Jr.

If you own and drive a vehicle in the Flint community, then you have likely grown accustomed to hefty insurance rates. This is because Michigan is the most expensive state for car insurance in all of the United States for the sixth consecutive year.

“The Wolverine State,” described in Insure.com’s 2019 edition of, car insurance rates by state, “is in a league of its own when it comes to car insurance, with an average annual premium that is $313 higher than that of Louisiana, which ranked second. A Michigan car insurance policy averages $2,611, which is almost 80 percent higher than the national average of $1,457.”

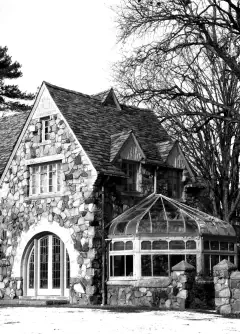

Downtown Flint has among the highest auto insurance rates in the state. (Photo by Jeffery l. Carey, Jr.)

And our very own Vehicle City, according to estimates on Lendingtree’s ValuePenguin insurance site, “is the fifth most expensive place in Michigan.” This means that if you are a driver in the city of Flint your average quote is about “$3,929 per year, about 35% more expensive than the state average.”

In an effort to change this, Governor Whitmer signed an historic bipartisan no-fault auto insurance reform bill. On May 30, 2019, the bill was passed in an effort to provide lower rates for Michigan drivers, to protect insurance coverage options, and to potentially strengthen consumer protections.

Currently, Michigan law requires drivers to carry unlimited medical coverage to pay for their expenses if injured in an auto accident. The new law, as outlined on the Michigan Department of Insurance and Financial Services (DIFS) site, “allows you to choose a level of medical coverage when your policy renews after July 1, 2020.”

According to DIFS, the new law should allow drivers to choose a level of medical coverage on their insurance plan. The insurance companies should then reduce the premium for the coverage section Personal Injury Protection known as PIP coverage. The amount of savings will then depend on the PIP option the customer selects.

As of now though, the new law is in a state of flux. “Every insurance company,” said John Potter of Potter & Roose of Flint, “had to first file new rating formulas, wait for approval, and then file new rates.” This means that most of the large insurance companies still don’t have the official rates approved by the DIFS to offer their clients.

Potter also noted, “The last I knew the commissioner was not approving the carriers request to do midterm changes on July 1. That could result in the rating changes not taking place until the first policy renewal following July 1.”

Is it the brick street that does it? Vies of Saginaw Street by Jeffery L. Carey, Jr.)

The DIFS’ site states that the new law requires that agents and insurers give their customers a form that describes the benefits and risks of the coverage options. Flintoids may also want to talk with an insurance agent to discuss their personal auto insurance needs.

Some other changes that may affect Michigan insurance policies are Residual Bodily Injury (BI) Coverage, changes in discounts, and Mini-Tort.

The new law under BI coverage, according to DIFS, “protects you from claims by other injured persons by increasing the minimum BI coverage limit an insurance company is required to offer you.” This means that this section of your rates may actually go up.

Potter states that, “the new law forbids the use of home ownership discounts, but still allows discounts for multi policy or Homeowners and Auto written with the same carrier. There are still discounts,” he added, “for quoting your coverage ahead of your expiration date, how long you are with your current carrier, and not cancelling in the middle of the policy period.”

The new law, under the DIFS’ Elimination of Non-Driving Factors section, “prohibits auto insurance companies from using sex, marital status, home ownership, credit score, educational level, occupation, and zip codes in setting your auto insurance rates.”

Under the DIFS’ section for Mini-Tort it states that the new law could increase the amount of money that could be recovered in small claims court for uninsured damages. This raises concerns about the potential rise in frivolous law suits and seems to turn Michigan’s auto insurance into a quasi-no-fault insurance.

“I’m afraid there will be people who move their insurance on July 2 for a small savings in the MCCA,” stated Potter about the uncertainties within the Michigan Catastrophic Claims Association, “when they would get a much larger savings if they wait until their expiration date.”

Potter recommends, at this point in time, being patient. “I have spoken with representatives from four of the largest writers of auto insurance in the state,” he said. “The consensus seems to be they are hoping to be ready by the end of March,” adding policy holders should begin to receive their options sometime in May for their July renewals.

For further information, DIFS’ website will be updated on an ongoing basis to provide the latest information to Michigan drivers as the effective dates of the new law approach. Please check www.michigan.gov/AutoInsurance for updates and educational materials.”

Banner photo of downtown Flint by Jeffrey L. Carey, Jr.

EVM Staff Writer Jeffrey L. Carey, Jr. can be reached at jlcareyjr@hotmail.com.

You must be logged in to post a comment.