By Tom Travis

Update: This article has been updated on March 27, 2023 to reflect more information from the Mayor and the city’s 2024 budget. Please note that entire city budget is available at the end of the article. And also, here.

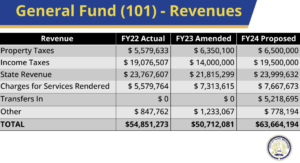

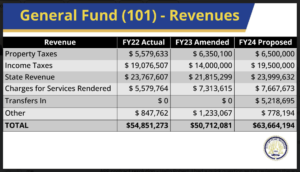

“This budget offers a level of stability,” Mayor Sheldon Neeley declared in his budget presentation to City Council’s Finance Committee. The 2024 proposed budget of $63 million reflects an increase of more than $9 million from the 2022 budget and a $13 million increase from the 2023 budget.

Neeley explained the budget priorities were to enhance public safety and city services, keep property tax rates unchanged, to meet Flint’s pension system obligations, and to keep fees and utility costs unchanged.

Council to conduct four budget hearings

The City Council will conduct four budget hearings during April where they will be able to ask questions to each of the city’s department heads. According to the city charter, the council must vote on the mayor’s proposed budget by the first Monday in June.

Mayor Neeley presents his 2023-2024 city budget to city council. (Photo by Tom Travis)

The budget presentation included, along with Neeley, the City’s Chief Financial Officer Rob Widigan and the City’s Chief Resilience Officer Lottie Ferguson. The mayor read from a prepared script to the council while 20 slides were cast onto a screen. The budget slide presentation is available below and a link to the entire city’s 2023-2024 budget is available at the end of the article or on the city’s website.

Neeley began the presentation by touting the city’s unemployment rate, stating in a cover letter with his budget, “From the spring of 2020 where Flint’s unemployment rate hit 45 percent, we have now seen a decline to a rate of 9.7 percent as of December 2022. This is the lowest rate on record since the late 1990s. which has fallen from 14.1% in 2020 to 9.7% in 2022.” He said more than 1,000 new jobs were added to Flint’s economy since 2020 and the city’s tax base is up 17% or $100 million since 2020.

The Mayor added these statistics concerning the local real estate market, “The real estate market has begun a slight recovery in the city of Flint. The city’s property tax base had fallen to $710 million in tax year 2016 but has rebounded to $836 million in tax year 2022. This represents

a 17 percent increase since the 2016 low point. However, we should all keep in mind that this is still a 50 percent drop from the 2008 high of $1.6 billion at the onset of the global financial crisis.”

Public safety

Neeley added that enhancements to public safety would include additions to personnel and equipment, noting the addition of body cams for the city police, improvements to the 24-hour intelligence center and included blight elimination as part of the public safety enhancements. The mayor’s proposed budgeted includes funds for the city’s senior centers, Hasselbring, Brennan, and Berston Field House.

City services

In August 2022 it was announced that the City of Flint would receive an infusion of $220 million from the State of Michigan coffers.

At the time of this announcement the administration assured residents this “infusion” of State funds would allow for the city to continue with basic services. With the additional $220 million from the State Treasury, the city will be able to allow critical city services to continue, Neeley explained. Without the infusion of state funds many critical services would be affected because the city would be required to pour funds into the mandated pension payment. CFO Widigan explained that the city has “a moral” and “a constitutional mandate to fulfill our promise to retirees,” As reported by East Village Magazine (EVM) in August 2022.

The Mayor explained, this budget does not contain the “infusion” funds from the State. The city does not know when those funds will arrive from the State. This infusion of pension assets will reduce the city’s required pension contribution. A rough estimate is that overall city pension payments will decrease to $24 million or a savings of $6 to $7 million for all city funds. The mayor reiterated this assurance in his budget presentation.

Revenues – “This is how we operate our community” Neeley

The Mayor explained the present city tax levy of 19.1 mills will not be increased in his budget.

A mill (millage) rate is the rate at which property taxes are levied on property. According to CFO Widigan, one mill generates approximately $895,646 for the city. Property taxes are computed by multiplying the taxable value of the property by the number of mill levied. A mill is 1/1000 of a dollar.

In addition, the city collects 32.0083 mills in taxes from the county, Intermediate School District, Mott Community College, The State of Michigan, Mass Transit Authority and the Flint Public Library, totaling 51.1083 mills.

“The main way we finance our community is through property tax. The Genesee County Land Bank (GCLB) possesses about 38% of the property inside the city of Flint and those properties generate no tax base for us. Also hospitals, schools and churches do not contribute to the property tax revenue for the city,” Neeley explained.

Revenue from State is up $2 million

Revenue from the State has increased by $2 million from $21.8 to $23.9 million and it comes from “a bouquet” of revenue streams within the State’s budget, Neeley said.

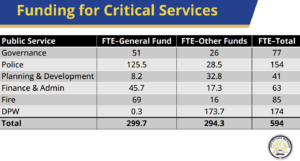

The City of Flint has increased the number of full-time employees to 594 including a total of 154 in the police department and 174 in department of public works.

City employee salaries, wages and fringe benefits increased from $45.4 million in 2022 to $47.5 million in 2023. In the proposed 2024 budget that figure will climb to $49.9. Supplies and operating costs for police and fire have fluctuated from $13.1 million in 2022, up to $17.1 million in 2023 and decreased to $16.1 million for proposed 2024 budget.

The mayor added that while the Great Lakes Water Authority (GLWA) will increase its water rates 2.75 % and sewer rates 2.75 % beginning in July, the City of Flint will not be increasing their rates.

We still have obstacles but we’re stronger together than we are divided. Structural, or more commonly called Operating Deficit, happens whenever current expenditures exceed revenues. An operating deficit doesn’t necessarily mean that the government has a budget deficit. This is because reserves, or fund balances, from previous years can be used to make up the difference.

In the proposed 2024 budget the revenues are projected at $63.6 million with expenditures at $66.6 million. (In comparison, the last two previous budgets were $54.8 million in revenue and $58.6 in expenditures for 2022 and $50.7 in revenue and $65.1 in expenditures for 2023).

“The city of Flint has a positive fund balance of $19.1 million as of FY2022,” according to CFO Widigan in an email to EVM.

Overview and Next Steps

Neeley wrapped up the presentation by saying, “Our largest single increased expense is meeting retiree and pension obligations. Any budget cuts would have a detrimental impact on our ability to provide city services.

“We face some uncertainty like workforce disruptions now and in the future, further rate hikes from the Federal Reserve, spending slowdown at the federal level, and uncertainty surrounding global and U.S. economic downturn or recovery,” he said.

No questions asked by council

The budget presentation took place four hours into a five and half hour series of committee meetings on Monday. At the conclusion of the 20-minute budget presentation Councilperson Dennis Pfeiffer motioned to end the special order budget presentation. In a 6-3 vote the motion passed with Councilpersons Eric Mays (Ward 1), Jerri Winfrey-Carter (Ward 5) and Tonya Burns (Ward 6) voting no.

Immediately after the vote Mays spoke up, saying Pfeiffer’s motion was appalling, reckless and an outrageous move. Mays was upset the presentation ended not allowing councilmembers to ask the mayor and administration questions. Finance Chair Judy Priestley (Ward 4) explained council will hold budget hearings on two Saturdays in April. The dates have not been set, as of yet, for those hearings. Once the April budget hearings are complete, the council is required to vote on the budget before it can be implemented.

The budget presentation ended at 10 p.m. After the mayor and his administration left the council continued on for less than an hour completing agendas for Legislative, Government Operations, Grant committees.

EVM Managing Editor Tom Travis can be reached at tomntravis@gmail.com

You must be logged in to post a comment.